Forget fumbling for cash or worrying about card fees eating into your travel budget. Pay By QR in Thailand has revolutionised how locals handle everyday transactions, and now it’s finally accessible to the rest of us. Here’s everything you need to know about getting started with QR payments as a foreigner in Thailand.

This page contains affiliate links. Please see our disclosure policy for more details.

Important Disclaimer: This article provides general information about payment methods in Thailand and is for educational purposes only. The information presented here is based on personal experience and research but should not be considered financial advice.

I’ve been living in Thailand for years, watching locals seamlessly scan QR codes to pay for everything from street food to hotel bills. Until recently, this convenient payment method was exclusively for Thai bank account holders. That’s changed. Three new options now let tourists and expats join Thailand’s cashless revolution without jumping through impossible banking hoops.

Here we go, everything you need to know about paying by QR code.

Pay By QR – What is it?

Just about every shop, restaurant, and hotel in Thailand offers a pay-by-QR option. It’s a straightforward concept where the individual or establishment’s bank account has been generated as a unique QR code. Using an app, the payee scans the code and can then pay via their banking app. It’s quick, easy, and there are no fees for either end. It’s a win-win.

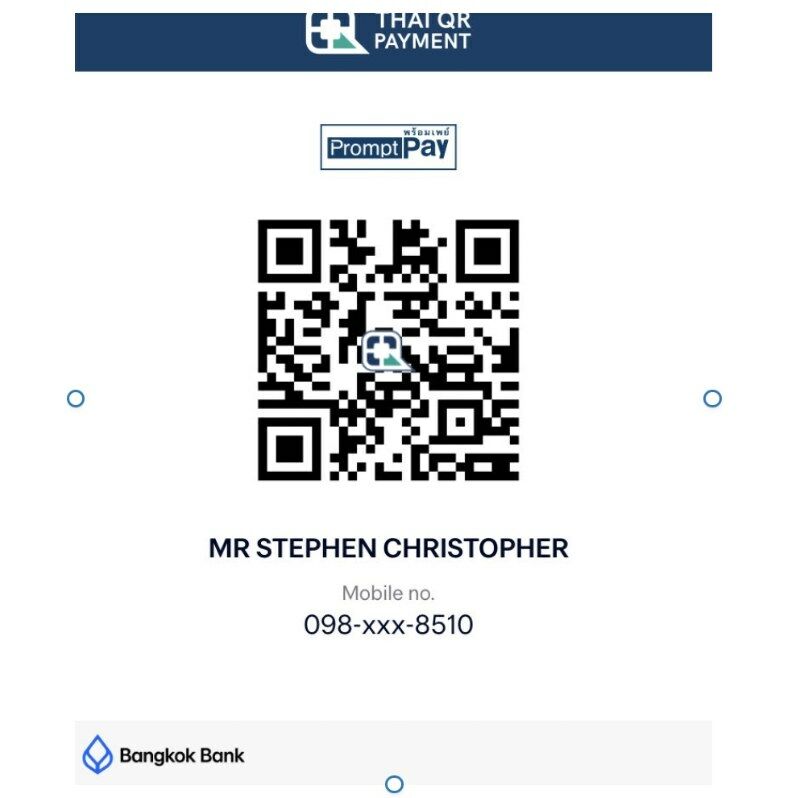

It was a lifeline during the COVID-19 pandemic when people were anxious about touching notes and coins. Even most local street food vendors now have a pay-by-QR code at their shops. Even if I want one of my friends to transfer some money to me, I can generate my QR code. It’s also very safe as it blocks out most of the numbers.

Here’s what mine looks like:

Why It Matters for Longer Stays

Using your account from your home country to pay for things in Thailand is convenient at first, but the fees add up. Even though withdrawing large amounts of cash at a time is the most cost-effective option, you’re still getting slugged. If you’re staying in Thailand as an expatriate on a Non-B or Non-O visa, you may be eligible for a Thai Bank account. If you’re here as a long-term tourist or on the new digital nomad visa, it’s much tougher to open an account. That’s no longer a problem, there are multiple ways you can use this function even if you’re not a local with a Thai bank account.

For the expats among you, I’ll first show you how to use your Thai bank account (but you probably already know!)

Pay With a Thai Bank Account

I’m an expat with a Thai bank account. The income that I earn from abroad, I transfer via Wise or Revolut into that account, and it becomes my working account for my daily expenses in Thailand.

Paying by QR from my Thai account is probably 90% of how I exist here. Here are the steps:

I’m going to transfer money from one of my accounts to the other via the QR code:

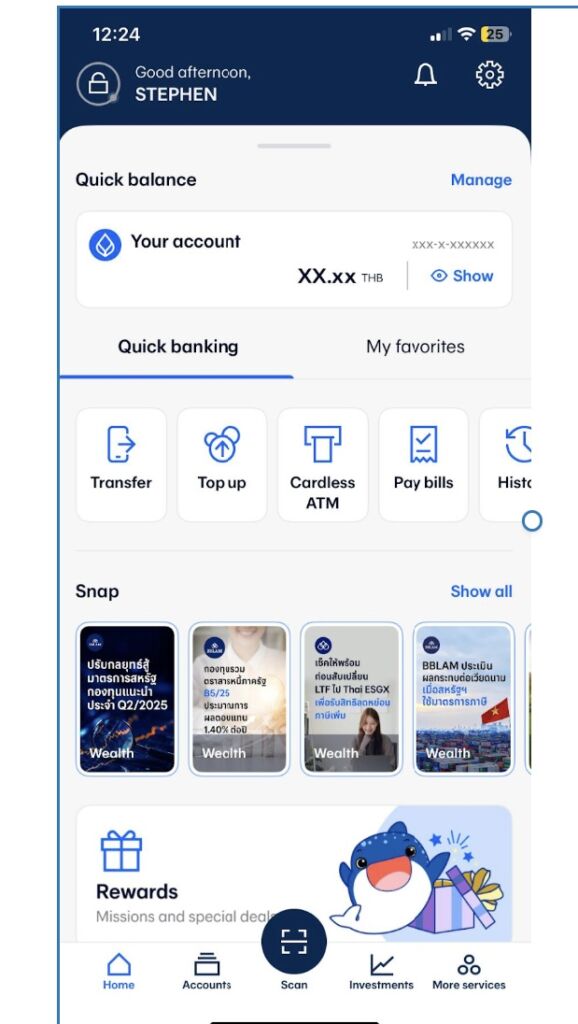

Open the bank app and click on the ‘scan’ button. It’s always really easy to find, in this case, it’s at the center bottom.

It will open up the phone’s camera so you can click on the QR code

Enter the amount. It will come up with the vendor’s account name for you to confirm, then accept. It’s instant, and they receive the funds immediately.

No Thai Bank Account, No Problem

Until just recently, only people with a Thai bank account could take advantage of the Pay by QR feature. Now, some banks and apps have jumped on the bandwagon, and while it’s early days and glitches are popping up, there are three potential options for you.

Quick Comparison of QR Payment Options

|

Feature |

Tag Thai |

True Money Wallet |

Moreta Pay |

|---|---|---|---|

|

Eligibility |

Age 20+, passport only |

Age 15+ with Non-B visa + work permit OR Non-O visa + Thai driver’s license |

Anyone with a US Bank account |

|

Set up location |

K Bank Foreign Exchange booth |

Online application |

Online only |

|

Set up time |

Immediate |

1-3 days |

Immediate |

|

Top up methods |

Foreign currency at Kbank booth |

Bank transfer, 7/11, bank |

Direct bank link |

|

Transaction limits |

100,000 Baht |

No specified |

No stated limits |

|

Fees |

No QR fees, 20 Baht ATM fee |

30 transactions free/month, then 25 baht each, 20 top-ups free/month |

No fees |

|

Special features |

Visa card enabled |

7/11 compatability |

1% cashback |

|

Main drawback |

Must top up in person |

Strict eligibility critera |

Currently US accounts only |

Note: All information current as of publication date. Check providers for latest details.

TAGTHAi Easy Pay

Tag Thai is an incentive by Kasikorn Bank (KBank) in Thailand to offer a prepaid card that can then be linked to an app to pay by QR. The Pay & Tour card itself is linked to Visa and can be used wherever it’s displayed.

Setting it up is easy enough if there’s a KBank Foreign Exchange booth near you. That’s great if you’re in a tourist area. I live in a rural part of Thailand, and my nearest one is a two-hour drive away, so it’s not an option for me right now. I will get it and update this blog.

It’s straightforward to register. Once you have the card, download the TagThai app, connect the card, and you can access the pay by QR feature.

There are no fees to set up or pay by QR, however, if you withdraw from a KBank ATM, the fee is 20 baht (around A$1/US$0.60).

You must be 20 and over to apply for a Pay&Tour card and have your passport handy.

Pros

- Easy to set up

- Accepted wherever Visa is displayed

- Pay by QR

- Withdraw from an ATM (Kbank)

Cons

- Daily limits of 100,000 baht

- Top-up physically at a KBank Foreign Exchange Booth

- Can only top-up in foreign currency, Thai Baht not accepted

- Users suggest the exchange rate isn’t competitive

Set up time

- In-person setup: 15-20 minutes at KBank Foreign Exchange booth

- App setup after getting card: 5-10 minutes

True Money Wallet

True Money Wallet is a very popular way to pay for goods and services as it’s widely accepted across Thailand, even in 7/11 stores, where it’s very hard to pay unless you have a credit card or cash. The Pay by QR feature is as straightforward as pressing the scan button on the app.

The challenge I found with True Money Wallet is that as a foreigner, you need to meet both of the following two criteria, and unfortunately (for now), I don’t.

Criteria 1

Hold a Non-B Visa and a work permit

Criteria 2

- Hold a Non-O visa and a Thai driver’s licence

I’m currently holding a one-year Non-O retirement visa, but I don’t have a Thai driver’s licence. However, I am planning to get one, so once again I’ll update this blog with screenshots and success stories.

If you meet either of the above criteria, go ahead and get a True Money Wallet, as it’ll be very convenient.

The application process is a little cumbersome, it seems to be more rigid than the alternatives. You download the app and submit a standard application by providing a photo of your passport and a selfie. Then you need to wait 1–3 days for a yes or no before you can complete the application. You need to have a fixed address in Thailand and provide copies of your visa and supporting documents listed above.

You then need to bind the True Money Wallet to your bank account. Topping up is easy, either transfer from your account, or go to any of the nine major Thai banks and top up over the counter, or at a 7/11 store.

As for fees, there are very few. You can top up to 20 times a month for free. After that, it’s 6 baht per top-up. Transfers and payments (including Pay by QR) are free for the first 30 transactions (so one a day) and 25 baht per transaction after that. This would end up being expensive for me as I do multiple pay-by-QR transactions a day.

You need to be 15 years old and above to apply, which seems young considering the fact that you need a work permit or a driver’s licence.

Pros

- Accepted widely across Thailand

- Very easy to top up

- Fee-free if you keep to the transaction limits

- Can be used at 7/11s

Cons

- Setting up requires many steps and document submissions

- The criteria are rather strict, so not everyone can apply

- Fees can get excessive if you surpass the transaction limits

True Money Wallet:

- Initial application: 10-15 minutes

- Approval wait time: 1-3 business days

- Final setup after approval: 15-20 minutes

- Total time: 1-4 days

Moreta Pay

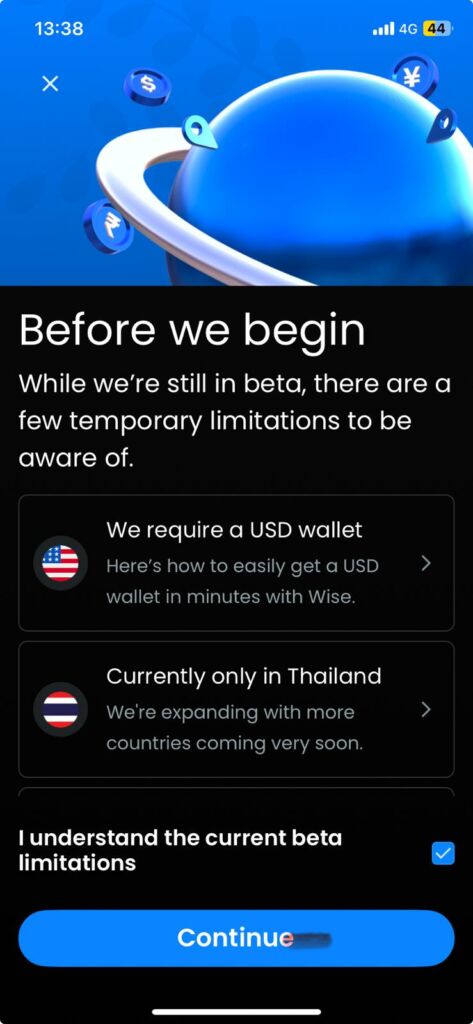

For me, Moreta Pay is the better option. I don’t need to meet any strict criteria; the only drawback for some people may be that, for now, it only connects to a US bank account. However, that includes Wise and Revolut, and I don’t know too many travelers these days who don’t have one or both of those.

The good news is that the following currencies will be allowed this year:

- CAD (Canadian Dollars)

- GBP (British Pounds)

- EUR (Euros)

- AUD (Australian Dollars)

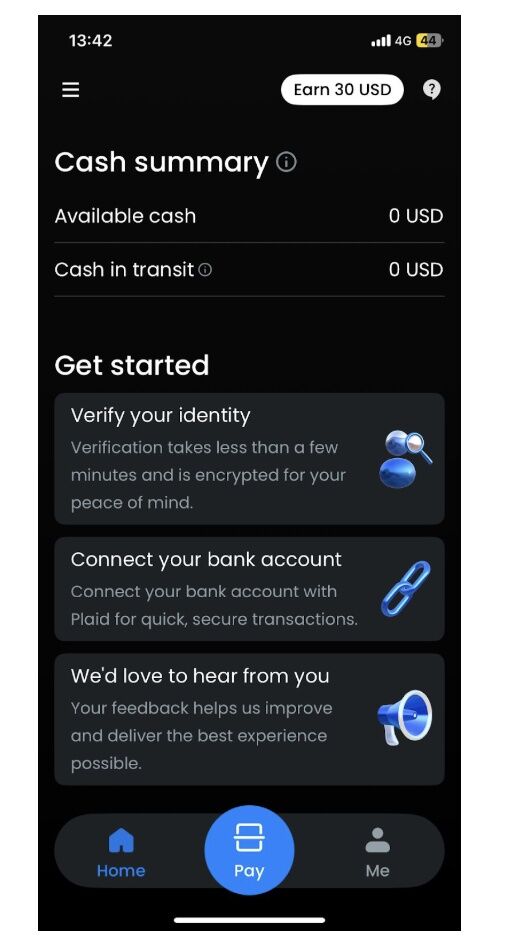

Moreta Pay allows you to pay by QR quickly and efficiently, just by clicking on the big blue pay button at the bottom centre.

There are absolutely no fees to use Moreta Pay, and the exchange rate is based on the mid-market rate, which you can see on Google every day.

A drawcard for Moreta Pay is that you earn 1% cashback on every purchase, which is added to your balance.

So no fees, and cash back. I’d be hard pressed to see why someone would choose one of the other options over this one (except perhaps for the limited currencies for now). Moreta does have a disclaimer that it’s still in beta mode, and more currencies and functions are coming:

Here’s how easy it is to set up:

Download the app from the Apple Store or Google Play

Open the app to the welcome screen and click ‘get started’. You’ll need your email address, a clever and secure password, which you’ll need to verify.

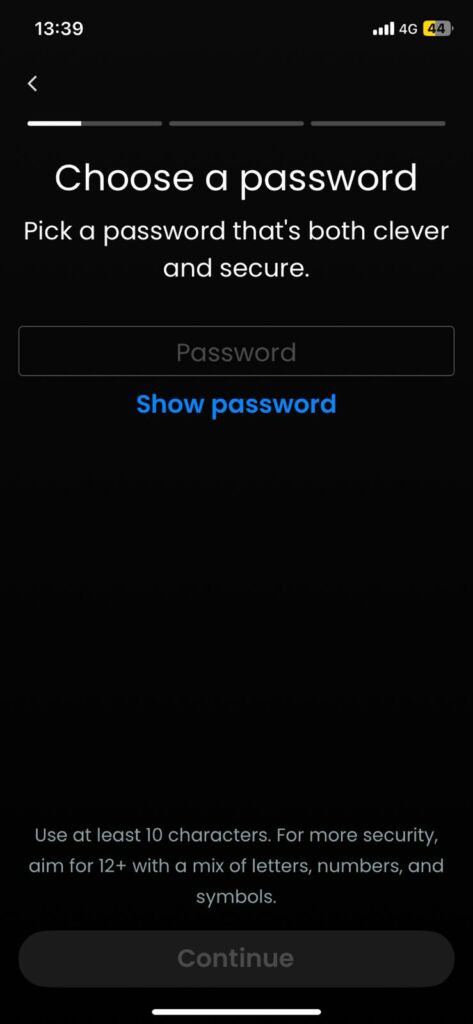

The next screen will ask you to choose a password.

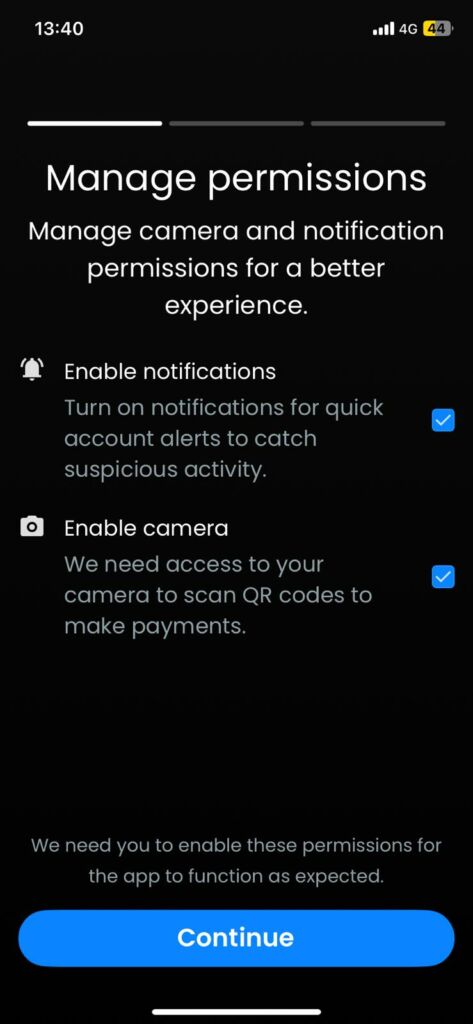

and then to enable notifications and camera settings. This is essential to scan the codes.

Next, you’ll be sent an OTP to your email address to be sure it’s you, and then you can go through the ID process, scan your passport, and take a selfie, or skip to go straight to the dashboard. Finally, link your USD bank account and add some funds, then go shopping.

Pros

- Easy to set up

- Absolutely no fees

- 1% cashback on purchases

Cons

- Currently only links to US bank accounts

Moreta Pay:

- Download and basic setup: 5-10 minutes

- ID verification (if chosen): 10-15 minutes

- Bank account linking: 5-10 minutes

- Total time: 20-35 minutes

Security When Using QR Payments

Before diving into the payment options, it’s important to understand some key security considerations:

Basic QR Safety

- Always verify the merchant name on your screen matches the business you’re paying

- Never scan QR codes from unofficial sources or random stickers

- Check that the payment amount matches what you’re being charged

- Keep your payment app updated to ensure latest security features

Protection Features

Each payment method offers different security measures:

Tag Thai

- Transaction PIN required for payments

- Daily spending limits of 100,000 baht

- Automatic system monitoring for suspicious activities

- Can instantly freeze card if lost

True Money Wallet

- Biometric authentication option

- Two-factor authentication for large transactions

- 24/7 fraud monitoring

- Instant transaction notifications

Moreta Pay

- US bank-level security standards

- Encrypted transactions

- Real-time fraud detection

- Transaction verification requirements

If Something Goes Wrong

- Screenshot any error messages

- Contact the payment provider immediately

- Document transaction details

- For Tag Thai: Contact KBank at 02-079-6069

- For True Money: 24/7 support at 1240

- For Moreta Pay: In-app support system

Pay By QR Has Never Been Easier

So there you are, join the 77 million Thai people who can pay by QR, avoiding the need to carry cash around. As tourists and expats, the function is now available to you by jumping through a few small hoops. Believe me, it’s worth it. It’s the best and most secure way to buy goods and services here in Thailand.

Disclaimer Payment systems, fees, and requirements can change frequently. Please verify current terms, conditions, and eligibility requirements directly with the service providers before making any financial decisions. Exchange rates and fees mentioned are examples only and may vary. We are not affiliated with or endorsed by any of the payment services mentioned.

Ready to start planning your Thailand trip? Our Facebook community Thailand Awaits Trip Planning for Beginners is here to help. Join fellow travellers, get your questions answered by Thailand experts, and access free planning resources to make your Thai adventure unforgettable.